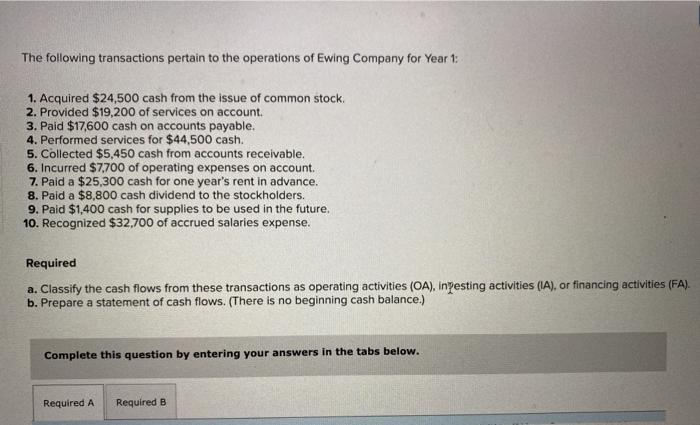

Specific Applications Render Certain Kinds of Guidelines For Military People And you will Family

Posted on Sep 22, 2024 in elitecashadvance.com+installment-loans-ga+oakwood get cash advance at bank

Conditions and terms to possess experienced home loan apps are very different by the condition. In many cases around s that require the new candidate to meet up a living limit. Various other you need-depending programs the new candidate may be needed is abandoned otherwise be in likelihood of installment loans Oakwood become homeless so you’re able to qualify.

Specific, like the , simply bring special interest speed savings and you will repaired speed mortgage loans having certified veterans and/otherwise household members. The Homefront program has the benefit of loans getting off costs and closure costs for the fresh get finance.

In some cases, including the Homefront program, going to a house customer’s orientation or house buyer guidance category is actually required since the an ailment of doing the program.

Some veteran-friendly condition apps offer a specific sort of let, such as for example deposit guidance. Applications from the nature was in fact available in Illinois such as for instance , which has considering $5,000 per loan to have off money, settlement costs, and other guidelines. So it assistance try available to Illinois Experts and army family members however, has also been wanted to earliest-big date people, repeat customers, and people looking to re-finance.

Some Applications Offer Maybe not Assistance, But alternatively The home Mortgage Itself

An inferior level of claims bring pros a home loan (that have veterinarian-friendly advantages otherwise incentives) unlike merely providing to greatly help purchase loan-oriented costs.

The condition of Oregon enjoys one such system explained toward formal site since independent and you will different from the fresh government Va Financial Warranty and keeps borrowed Oregonians just as much as $8 million regarding reasonable-attention lenders to help you more 334,100000 veterans.

This Oregon county veteran’s home loan work with is actually a traditional loan readily available for holder-occupied solitary family residential property. You can get a property around so it Oregon program for many who be considered with armed forces services even if you dont reside in the state; the sole requirement is the fact that family purchased with this Oregon condition veteran’s mortgage choice be located inside condition traces and are occupied from the debtor within this a fair amount of time just after closure.

Certain Experienced-Amicable Loan Applications Aren’t Restricted to Veteran Or Currently Serving Armed forces Members

Brand new Colorado Housing Power enjoys an excellent exemplory instance of a veterinarian-friendly mortgage loan program that is not limited to military members in addition to their family. The fresh Colorado FirstStep and you can FirstStep Together with home loan applications are created for first-date homeowners, certified experts, and you may low-first-go out homebuyers buying inside focused components with regards to the certified website.

This method, as you can tell in the significantly more than, doesn’t limit by itself so you can armed forces house seekers. However, there are numerous extremely important restrictions to that particular variety of program plus:

- Provided for brand new get home loans merely

- Income hats and household speed restrictions apply

- Limited to own FHA 203(b) mortgages

- Minimal FICO rating specifications includes 620+ however, borrowers without credit rating are permitted

- There’s also an excellent CHFA 2nd Mortgage program offered with down-payment direction, which help some other expenditures

Certain Software Usually do not Let Up to Adopting the Selling

There are various condition-work with programs that don’t ability assistance with down costs or home loans on their own, but rather provide income tax credits. You to definitely good example is the Delaware Very first-Date Homebuyer Tax Borrowing from the bank which is a taxation borrowing from the bank that’s best for thirty-five% of your home loan interest repaid on a max advantage of $dos,one hundred thousand per year.

- Satisfy an income cover

- Has actually children earnings below the limitation money restrictions toward system

- Entertain your house purchased as the no. 1 residence

- Not have owned property in past times 3 years because the your primary residence

The final demands are waived for those implementing that have a great Certified Seasoned Exception to this rule and this must be filed into the app for this Delaware program.