As an alternative, their lender can also provide the accessibility to a higher level mortgage in exchange for zero closing costs

Posted on Aug 11, 2024 in paydayloanalabama.com+pollard my payday loan

Just like taking right out an initial home loan toward a home, refinancing pertains to settlement costs. They are able to include the cost of an assessment, app charge, and even attorney costs. You have got choices for expenses some of these costs and you may costs. Expenses her or him at the start is frequently the cheapest choice. If you’re unable to afford to afford the closing costs up front, the lender can get will let you move her or him with the mortgage. you would not spend currency now, you’ll end up repaying interest towards men and women charge and expenses over living of your own mortgage.

If you want individual financial insurance policies, which is always needed should your collateral are less than 20% of the value of your property, that can be some other prices to look at.

The taxes is generally impacted by refinancing also. If you itemize, you may be accustomed to bringing a great deduction into the focus paid down on your own financial. A general change in the rate you will definitely replace the quantity of the deduction, that can be an issue to have tax planning. The amount that your taxes would-be impacted depends on the amount of decades paid on the totally new loan, the latest financing title, and as chatted about below, towards measurements of the loan balance.

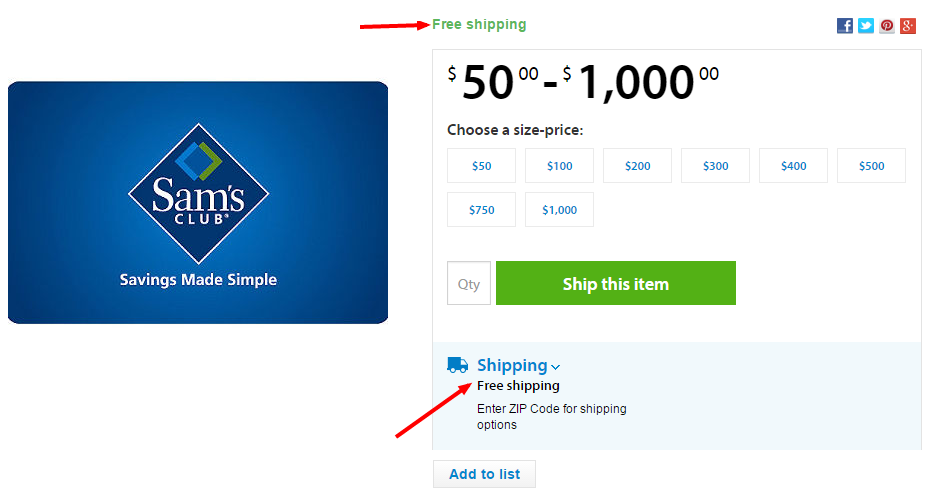

When you yourself have financing for more than $750,one hundred thousand, up to $1 million, that has been applied for just before , another attention could be the restrictions oriented by Tax Slices and you can Operate Act (TCJA). The fresh TCJA limited the home financial desire deduction to attract reduced to your first $750,000 off a home loan. Refinancing over you to definitely amount can result in a smaller sized deduction should your fresh financing predates new laws.

When you refinance, appeal initial gets a larger part of the commission relative to prominent. That ount away from financial attention you’ll be able to deduct-about on the basic $750,100 of one’s mortgage.

Know Palms

That have a changeable-speed home loan (ARM), the interest rate is fixed getting a predetermined number of years, after which they fluctuates, inside limits, toward leftover identity of loan. An example try good 7/1 Arm. The new 7 refers to the few years just before a modification can be produced. After the 7th 12 months, the borrowed funds could possibly get to improve annually. Price transform decided of the a benchmark index as well as a beneficial margin commission put from the financial.

If you have an arm and are usually worried about speed resets subsequently, it creates sense to re-finance with the a predetermined-speed financing for taking benefit of lower prices. A few of the considerations is when your most recent loan resets and the length of time you intend to reside in the house. There may be limits about precisely how much your rates you’ll to improve from year to year as well as over the brand new longevity of the borrowed funds.

Exactly what else should you decide learn?

- If you’re planning to go next couple of years, refinancing will not add up. To understand when it do make sense, determine their breakeven part. Start by the expense of refinancing and then separate they by how much cash you’ll be able to save yourself each month of the refinancing. That can make you a rough notion of how many weeks it entails for your refinance to pay off.

- Definitely look at rates round the various lenders. To begin, view price aggregator web sites that demonstrate shot Pollard payday loans no bank account rates of interest (for example Bankrate and you will NerdWallet) understand the fresh new rates you might find. There are also other sites that give you a more individualized rates out of several loan providers (like Credible and you will Financing Forest). Sometimes a knowledgeable offer is not available as a result of a bank-borrowing unions or loyal mortgage financing businesses may offer aggressive pricing.